ASX-listed Triangle Energy has banked a trifecta in the Philippines, bagging two offshore and one onshore petroleum exploration licences, which the company says have handed it a commanding position in some of the region’s most prospective, underexplored terrain. With contingent resources in the hundreds of billions of cubic feet and gas-hungry markets on tap, Triangle is now sitting on what could be Southeast Asia’s next major gas story.

ASX-listed Triangle Energy looks like it has pulled off a strategic coup in Southeast Asia, securing three petroleum licences across the Philippines, including two offshore permits in the gas-rich Sulu Sea and a third onshore in northern Luzon.

Capping off two years of determined groundwork - and bolstered by crucial backing from the Australian Embassy in Manila and Austrade - Triangle says the achievement marks a major new country entry, handing the company operatorship and commanding stakes across all three high-impact Philippines blocks.

The newly awarded offshore SC-80 and SC-81 blocks are regarded as some of the region’s most underexplored, high-potential territories and are administered by the Bangsamoro Autonomous Region of Muslim Mindanao (BARMM).

BARMM which was formed in 2019 as a fresh political region in the southern Philippines to cater for the needs of the Muslim-majority population.

The blocks sit directly north of Malaysia’s Sabah and lie within the Sula Sea’s Sandakan Basin, which is the least explored area of the prolific Circum-Borneo Basin system.

What first drew Triangle’s eye to the acreage was the groundwork laid by Mitra Energy and its senior partner and oil giant, Exxon, which sank three wells between 2009 and 2010 to deliver two gas discoveries - an enviable hit rate by any explorer’s standards.

The two finds - dubbed Dabakan-1 and Palendag-1 - came up trumps with a big resource of 470 billion cubic feet (Bcf) of gas and 5 million barrels (MMbbl) of condensate in the 2c recoverable category.

Exxon however, elected to simply walk away from the play due to low gas prices at the time, leaving Mitra as the sole operator of the blocks. Mitra was then taken over by Jadestone Energy, who then relinquished the blocks in 2018 to focus on oil, leaving the licences vacant and up for grabs.

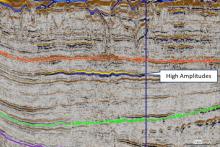

Triangle has since done significant groundwork on the blocks using extensive 2D and 3D seismic surveys left behind by Exxon to pinpoint several lookalikes and it has landed on a massive primary target called Halcon.

Described by management as a very large “basin floor fan” structure, the company believes Halcon is hugely prospective and could contain between three and as much as a whopping 6 trillion cubic feet (Tcf) of gas in resource.

Backing Triangle in its offshore push, UK-based Sunda Energy has snapped up an equal 37.5 per cent stake in the venture. Staffed by several former Mitra geoscientists familiar with the region, Sunda brings a wealth of local know-how - making it an exceptionally well-matched partner capable of unlocking the Sulu Sea’s untapped potential.

The remaining partners, Phillodrill and PXP Energy, were invited to bring up the rear with a 12.5 per cent share each. Their involvement as local Philippines companies is seen as a savvy move that will likely ease the path to what are already some of the best fiscal terms in the world.

Triangle Energy Global managing director Conrad Todd said: “We are delighted to add these high impact exploration Service Contracts to our portfolio. The awards are the culmination of substantial effort by Triangle and its JV partners, which we expect will lead to the drilling of significant exploration upside in these contracts.”

Triangle’s third prize – the wholly owned and freshly minted SC-82 onshore block - is a sprawling license covering an eye-popping 4,700 square kilometres of ground, which encompasses the gas-prone Cagayan Basin.

Sitting 250km north of Manila on the main northern island of Luzon, Triangle sees the territory as an excellent addition with enormous near-grid upside and is already home to known gas discoveries in a region hungry for energy.

The block includes the historic Nassiping-2 gas discovery, which intersected 244m of gas shows in carbonate reservoirs. It sits just 700 metres from existing power infrastructure. While mechanical issues halted full testing of that well in the 1980’s, Triangle sees strong similarities to the adjacent San Antonio gas field, which fed the local power station for 14 years.

The company’s next step with the onshore block is to crunch the historic seismic and volumetric modelling data before zeroing in on drilling targets, Meanwhile the company can then accelerate work once joint venture partners have been brought into the fold.

The Philippines currently sources 30 per cent of its power from gas and that demand is only rising as the country becomes more affluent. However, most of its gas comes from the ageing offshore Malampaya field in the West Philippine Sea, making new domestic discoveries a national priority. Triangle’s new permits therefore look perfectly timed and set the stage for the company to step right into the spotlight as the Philippines braces for its looming gas shortfall.

With contingent and prospective gas resources across both shallow and deepwater plays, access to market via existing power infrastructure and a government eager for local energy solutions, Triangle Energy may have just unlocked the next chapter in the Philippines’ energy evolution.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au