Triangle Energy and its joint venture partner Athena Exploration have substantially boosted gas resources at their UK North Sea permit, marking a significant milestone for the two companies. The marked increase in both contingent and prospective resources positions the partners among the top three holders of undeveloped gas resources in the UK west of the Shetland Islands and in the southern North Sea.

Triangle Energy and its joint venture (JV) partner Athena Exploration have substantially boosted gas resources at the JV’s North Sea permit in the United Kingdom, marking a significant milestone for the two companies.

The marked increase in both contingent and prospective resources positions the partners among the top three holders of undeveloped gas resources in the UK, in an area west of the Shetland Islands and in the southern North Sea, according to industry analysis firm Welligence Energy Analytics.

The Cragganmore gas field, sitting within the permit, is at the heart of today’s ASX announcement. Athena operates the project within the 50:50 joint venture.

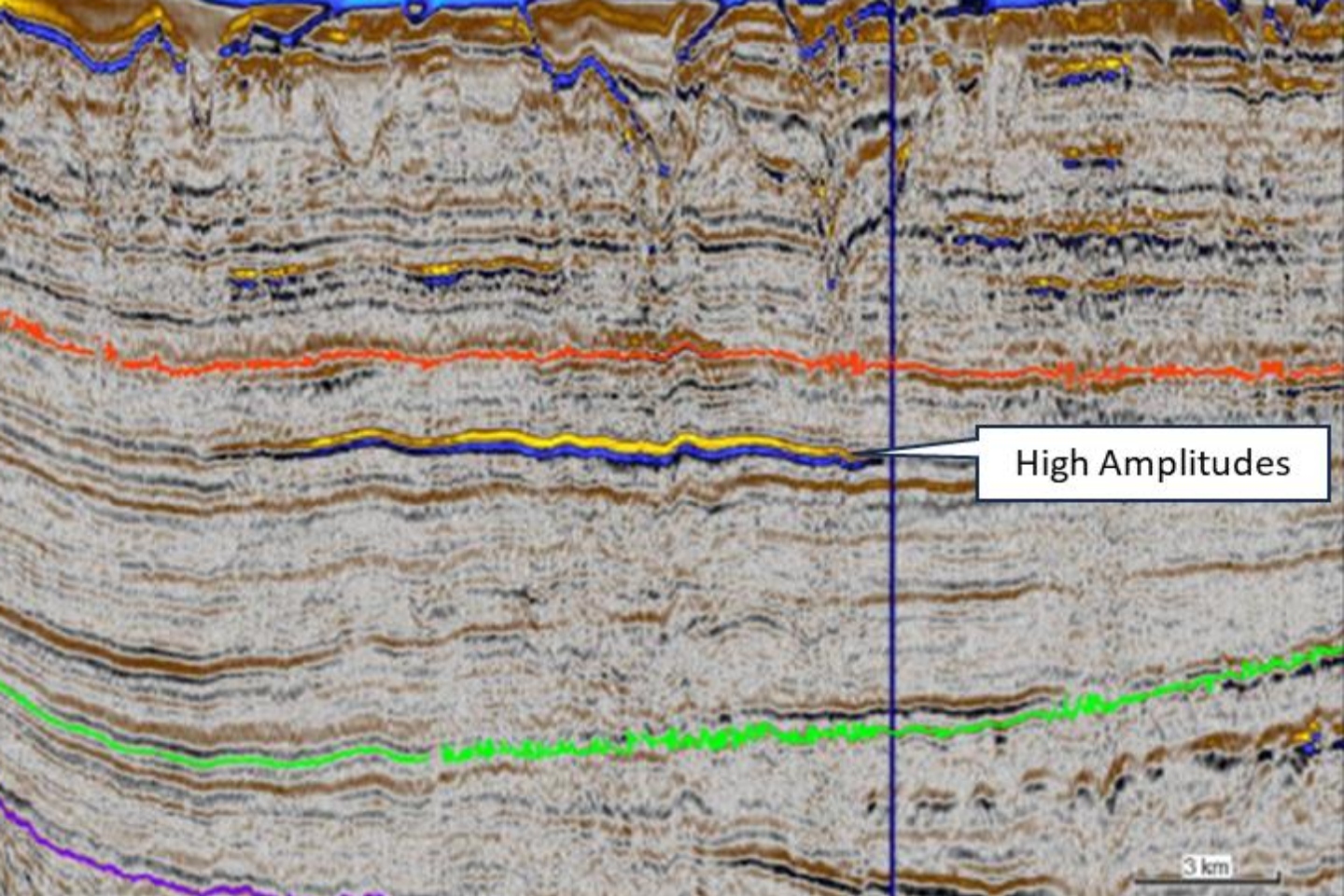

Athena’s comprehensive geotechnical and resource study, reinterpreting seismic and well data to improve the understanding of the structure and stratigraphy of the asset, delivered a considerable boost to contingent and prospective resources.

Cragganmore’s updated contingent resources now range from 499 billion cubic feet (Bcf) 1C or low-case recoverable gas to 929Bcf 3C or high-case recoverable gas. A 2C or mid-case estimate of 683Bcf recoverable gas is based on a gross 100 per cent interest.

Beyond Cragganmore, the study identified seven additional prospects within the permit, each with significant exploration potential. The Lamba, Benriach, Linkwood, Glenfarclas, Benrinnies, Bow Castle and Cragganmore Downdip prospects collectively contribute to a prospective resource ranging from 1058Bcf 1U low-case to 2098Bcf 3U high-case, with a 2U mid-case of 1490Bcf.

The geological chance of success across the prospects range from 30 per cent at the Cragganmore Downdip prospect to 51 per cent at three prospects, Glenfarclas, Benrinnies and Bow Castle, indicating moderate to high confidence in future discoveries.

The company notes further exploratory evaluation will be required to determine the existence of a potentially large quantity of hydrocarbons.

Triangle management says the resource upgrade significantly enhances the value of its UK assets and bolsters its position in the European energy market.

Triangle Energy managing director Conrad Todd said: “We are pleased to report that the joint venture with Athena has completed the first part of the work program by undertaking a geotechnical and resource review, using seismic AVO modelling to determine the presence and extent of gas sand reservoirs within the permit. This has resulted in a significant increase in resources attributable to these permits, which will add to their value.”

The Cragganmore field is defined by three wells - two confirmed a gas presence within an area of high amplitudes. Reprocessed seismic data is expected to further refine gas-bearing reservoir mapping and support future development planning.

The JV plans further studies to assess reservoir quality and deliverability, which will inform future appraisal and development decisions, along with optimising upcoming drilling programs.

An Energy Profits Levy (EPL), introduced in May 2022, has become a bone of contention between UK oil and gas players and the government. Then prime minister Rishi Sunak’s government brought in the levy after the industry recorded sky-high profits due to elevated energy prices, courtesy of Russia’s invasion of Ukraine.

The ‘windfall tax’ places an additional impost on top of the normal company tax rate, which is already set at a higher level for profits from oil and gas production.

Increases since have set the rate progressively higher. A rise in the most recent UK budget means oil and gas producers are now paying a startlingly high headline tax rate of 78 per cent. The tax slug is expected to remain until 2030.

After much angst from energy players, which complained about the one-sided nature of the tax not considering the notorious volatility of oil and gas prices, the government adjusted the policy by introducing a “balancing” Energy Security Investment Mechanism.

This ensures the EPL ceases to apply to producers’ profits if the average price of both oil and gas falls below the mechanism threshold of US$76.12 ($117) per barrel of crude oil and 59 British pence (A$1.23) per therm over a six-month reference period.

The price of oil and gas has normalised since the fiscal policy was introduced, all but demolishing the industry’s previous windfall gains, leading to a precipitous fall in North Sea investment, production and profits.

Industry continues to cry “foul play”, which has pushed the UK’s Energy Security and Net Zero Department to open a dialogue with explorers and producers to develop a plan to deliver a fair return for the nation during times of unusually high prices. This is expected to culminate in an updated tax regime by the next budget time in October.

With the Cragganmore field and surrounding prospects showing strong potential and the JV’s UK venture shaping up to be a cornerstone of the company’s international growth strategy, Triangle is well-positioned to maintain its strong momentum in a highly promising offshore gas play and capitalise on Europe’s ongoing demand for reliable gas supply.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au