Meeka Metals has struck multiple, high-grade ore topping 300 grams per tonne gold at its Andy Well project in WA – the company’s first underground mine at the Murchison project in WA. The underground development began in July, with the high-grade ore now feeding the plant and pushing October output toward 3800 ounces as the company adds a third jumbo continuing its ramp toward seven levels in ore.

Meeka Metals has driven straight into the heart of some super-rich ore at its new Andy Well underground mine in Western Australia’s Murchison, confirming the company’s long held belief of high-grade lodes sitting beneath its existing open pit which look to offer plenty of sting in the tail.

It is the first horizontal mining drive at Andy Well with the latest tunnel cutting through the Wilber lode about 150m below surface. The results appear to be the first direct confirmation the underground ore matches, and even exceeds, Meeka’s high-grade expectations.

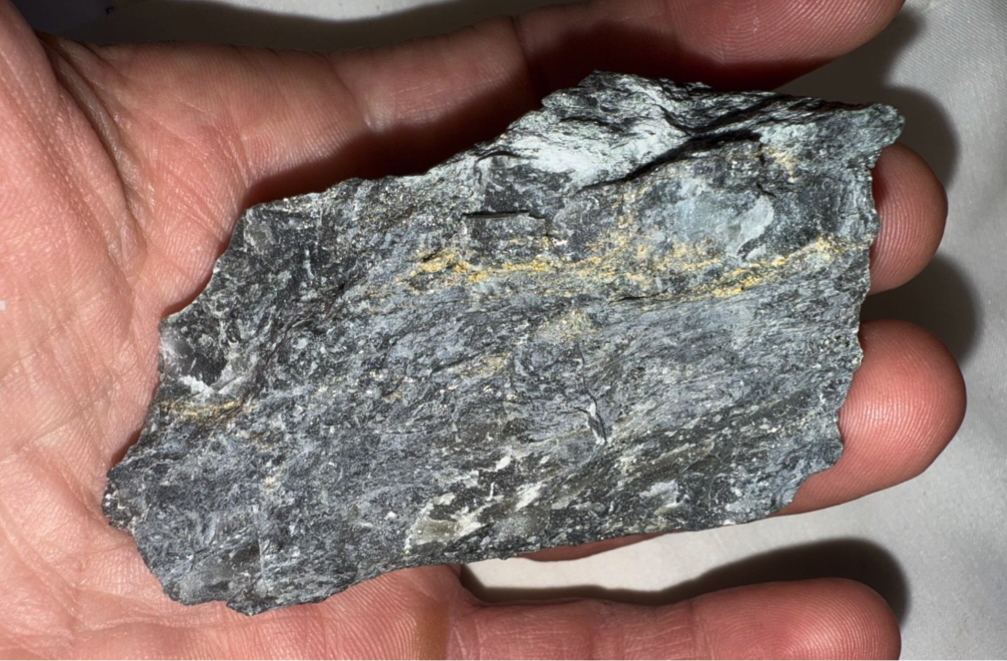

Intervals of 0.4 metres running at 276 g/t, to as high as 373 g/t, in visible-gold zones have now been intersected with the broader three to four metres averaging between 15 and 30 g/t, eclipsing the company’s grade-control model.

Underground development first kicked off in July with ore access established in September, marking Meeka’s rapid transition from developer to two-stream producer. The company says three ore levels are now in development, with four more to follow this quarter.

It is the latest milestone in what has been an impressively rapid build-out at the Murchison project. The processing plant poured its first gold on 1 July 2025, only 12 months after ground was broken and commissioning has since flowed into a steady ramp-up.

Gold production hit 7148 ounces in the September quarter at an all-in sustaining cost of just $2133 per ounce, comfortably ahead of the feasibility-study start-up plan and significantly under the current gold spot price of around $6000 per ounce. Throughput and recoveries, which have been sitting at about 98 per cent would be the envy of other producers and are also above Meeka’s own expectations. An open-pit reconciliation also shows 38 per cent more gold mined than modelled.

Those metrics, combined with the underground grade outperformance, suggest the company may be building headroom across both ends of its operation. The new underground ore is already feeding the plant, pushing October production towards another 3800 ounces providing a richer blend which should lift the overall grade.

Meeka’s owner-operator model, covering both open-pit and underground mining, was designed to keep margins tight and control high. Importantly, the company’s September report also shows cash and gold holdings of almost $60 million with no debt beyond equipment finance.

Managing director Tim Davidson said the development of these first faces were a powerful reminder of Andy Well’s pedigree.

He said; “These +100g/t gold grades are typical of the Andy Well mineralisation and reinforce the potential grade upside from this mine,” he said. “Historically, 23 per cent more gold was recovered from the mine between 2013 and 2017 than predicted in the Resource, and the grade outperformance we are seeing in this initial ore development supports this.”

The current underground resource sits at 500,000 ounces grading more-than-an impressive 8.6 g/t gold, forming part of Meeka’s 1.2-million-ounce inventory across the wider Murchison Gold Project. Davidson said next year’s focus will be on the shallower Wilber, Judy and Suzie lodes which all sit within about 200 metres of surface and are reachable from the existing decline. The company said the opportunity here is to drive even stronger near-term cashflows while deeper drilling should underpin longer-term growth.

Meeka’s recent July presentation at Noosa hinted toward that same twin-track strategy: rapid production and organic expansion underwritten by ownership of every moving part. With the processing plant performing above plan, three open pits at steady state and now underground ore grading like the old Andy Well glory days, Meeka’s first foray into gold mining is a bit of a freak by peer standards.

Its evolution over the past 18 months, from explorer to fully fledged gold producer, has been uncommonly fast in a sector where timelines often drift. Its ability to pour first gold within a year, keep unit costs under control and then immediately deliver underground ore of this calibre puts it in very select company.

There is, of course, a long way between face grades and banked ounces. But if these early reconciliation trends hold and the shallow lodes deliver as planned, Meeka’s move underground could prove the start of a golden second chapter at the Murchison.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au