Carnaby Resources has exercised its right of first refusal to acquire Latitude 66 Limited’s 17.5 per cent stake in the Greater Duchess copper-gold joint venture in Queensland for $6 million.

Under the JV’s binding heads of agreement, the transaction includes a consideration to Latitude of $2 million in cash and $4 million in fully paid Carnaby shares, priced at the 30-day volume-weighted average price up to today.

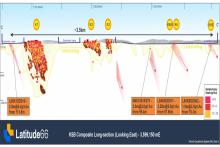

The Greater Duchess JV is part of the Greater Duchess copper-gold project about 70 kilometres southeast of Mount Isa. The venture is based on 12 exploration permits for minerals and has a combined mineral estimate from the Lady Fanny, Nil Desperanum, Duchess, Burke and Wills and Mt Birnie projects.

Early this month, Latitude 66 signed a non-binding terms sheet to sell its JV stake to Argonaut Partners and Neon Space, subject to partner Carnaby not exercising its right of first refusal. Carnaby’s decision to proceed has secured the full A$6 million consideration for Latitude 66.

Latitude 66 managing director Grant Coyle said: “Carnaby’s exercise of its first right of refusal has maximised the Greater Duchess JV sale transaction value for Latitude 66, unlocking $6 million from a non-core asset.”

Coyle said the outcome was positive for Latitude’s shareholders and would provide significant non-dilutive funding that the company will now redirect towards advancing its high-potential exploration assets in Western Australia and Finland.

Carnaby Resources’ managing director Rob Watkins said the transaction will enable his company to access the full development and exploration potential of the Greater Duchess project.

Both parties aim to finalise formal documentation promptly, targeting completion within the current quarter.

The divestment of the non-core Queensland JV asset strengthens Latitude 66’s balance sheet and positions the company to capitalise on its other exploration opportunities.

With a fresh $6 million in hand, Latitude 66 is well-funded and poised to accelerate its exploration to unlock the potential of its WA and Finnish assets.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au