Latitude 66 has signed a deal to sell its 17.5 per cent interest in the Greater Duchess copper-gold joint venture in Queensland for $2 million upfront. The agreement includes a potential $4 million bonus if the entire JV is sold within 90 days. The move unlocks non-dilutive cash and aligns with the company’s strategy to monetise non-core Australian assets while focusing on projects in WA and Finland.

Latitude 66 has cashed in on a non-core asset, locking in $2 million in upfront funding by selling its 17.5 per cent stake in the Greater Duchess copper-gold project in Queensland, which it owns with ASX-listed Carnaby Resources.

The company has also positioned itself for a further $4 million windfall if the full project changes hands in the coming months.

The company has signed a non-binding term sheet with Argonaut Partners and Neon Space to offload its interest, with a baked-in bonus clause.

If the entire joint venture is snapped up within 90 days of the announcement, Latitude will receive a further $4 million in cash or the same value in ASX-listed shares, based on the 30-day volume-weighted average price.

Alternatively, if the new buyers decide to flick the stake onto a third party other than Carnaby, the company could still bank 50 per cent of any upside above $4 million, giving the deal serious contingent kicker potential.

Under the joint venture terms, Carnaby has been formally offered the same deal under a right-of-first-refusal clause. It now has 30 days to match the terms and acquire Latitude’s share itself.

If Carnaby exercises its right, Argonaut and Neon Space will be compensated with 7.5 million unlisted options in Latitude, exercisable at 7.5 cents and valid until June 2028.

Latitude 66 managing director Grant Coyle said: “The Greater Duchess joint venture is a non-core asset and the sale transaction announced today is in line with our strategy to unlock value from our Australian assets. This transaction is well timed to provide Lat66 with near term, non-dilutive funding that will enable the company to continue advancing its Finnish and Western Australian projects.”

To help smooth the transaction, Argonaut has also agreed to provide Latitude with a $750,000 unsecured loan, bearing 1 per cent monthly interest from October, to support operations in the near term. The loan comes with a $30,000 establishment fee. Repayment is linked to key milestones in the joint venture sale process, including a 12-month sunset date.

The Greater Duchess copper and gold project sits 70 kilometres southeast of Mount Isa and includes several copper-gold prospects, such as Lady Fanny, Nil Desperandum, Duchess, Burke and Wills.

The project is currently undergoing a prefeasibility study, expected just around the corner, and already has a hefty global resource of 315,000 tonnes copper equivalent in the bank.

Momentum surged earlier in the year after Carnaby snapped up the nearby Trekelano deposit from Chinova Resources, adding 85,000t of copper equivalent at a healthy 1.6 per cent grade to the mix.

In a major strategic coup, Carnaby also locked in a binding offtake deal with mining heavyweight Glencore, which will toll treat all of the sulphide ore and concentrate from Greater Duchess.

The Greater Duchess sale concludes Latitude’s involvement in the Queensland project, while freeing up capital to accelerate its Scandinavian and domestic exploration ambitions without resorting to fresh equity.

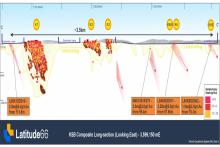

In Finland, the company is ploughing ahead with exploration at its KSB project. Recent drilling has uncovered broad zones of anomalous mineralisation just south of its flagship K1 prospect, which already hosts 650,000 ounces of gold and 5800t of cobalt.

While only one drill hole hit mineralisation, it aligns with a weak but strengthening geophysical signal dipping to the east. The tenor and distribution of mineralisation appears to form the outer halo of a much larger system at depth.

Notably, induced polarisation chargeability peaked in a fold hinge - a structure known for hosting high-grade deposits - pointing to some exciting potential. Latitude now plans to refine its target with more geophysics and mapping.

In Western Australia, the company is planning to get the rigs spinning at its promising fully owned Edjudina gold project.

Latitude’s grounds cover 1193 square kilometres and sit at the southern end of the fabled 40-million-ounce Laverton tectonic zone in the State’s Eastern Goldfields.

The project is next door to Kalgoorlie Gold Mining’s recent eye-catching high-grade supergene gold discovery at Lighthorse. KalGold’s new find got tongues wagging after pulling in a hit of 8 metres grading 9.21 grams per tonne (g/t) gold from 52m within a broader 17m zone of 4.81g/t gold from 48m.

Edjudina is now primed for a 9000m air core blitz targeting multiple gold anomalies. Key prospects include Hercules, a 7km soil anomaly peaking at 92 parts per billion (ppb) gold, and Falcon, with up to 98ppb over 1.3km. Previous hits at Colossus and Spartan, such as 1m at 3.4g/t, also demand a closer look.

As copper and gold prices continue to turn heads globally, Latitude’s well-timed divestment appears to offer a savvy exit from a dormant holding, with the chance to bank a kicker if corporate activity heats up in the region.

And with fresh cash now in the coffers, the company is primed to shift into top gear, ready to chase big discoveries across projects in which it controls its destiny. For a junior miner on the move, it’s a strategic shuffle that could really pay off.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au