Dateline Resources has hit yet more solid gold intercepts from beneath the North pit at its Colosseum project in California, delivering wide zones of gold up to 132.6m grading 0.95 grams per tonne. Importantly, the results surpass the grades in the nearby resource blocks surrounding the mineralised intercepts hinting at an upgrade in ounces for the company.

Dateline Resources has hit yet more solid gold intercepts from beneath the North pit at its Colosseum project in California, delivering wide zones of gold up to 132.6 metres grading 0.95 grams per tonne.

The standout hole cut 64m running at 1.24 grams per tonne (g/t) gold from the bottom of the pit, packed with higher-grade stretches such as 7.66m at 3.16g/t gold from 53.3m below the base of old mine .

The bigger 132.6-metre hit included higher grade sections of 3.05m grading 3.25g/t gold from 27.4m and 3.05m going 7.09g/t gold from 112.8m.

Importantly, the results surpass the grades in the nearby resource blocks surrounding the mineralised intercepts, hinting at an upgrade in ounces for the company.

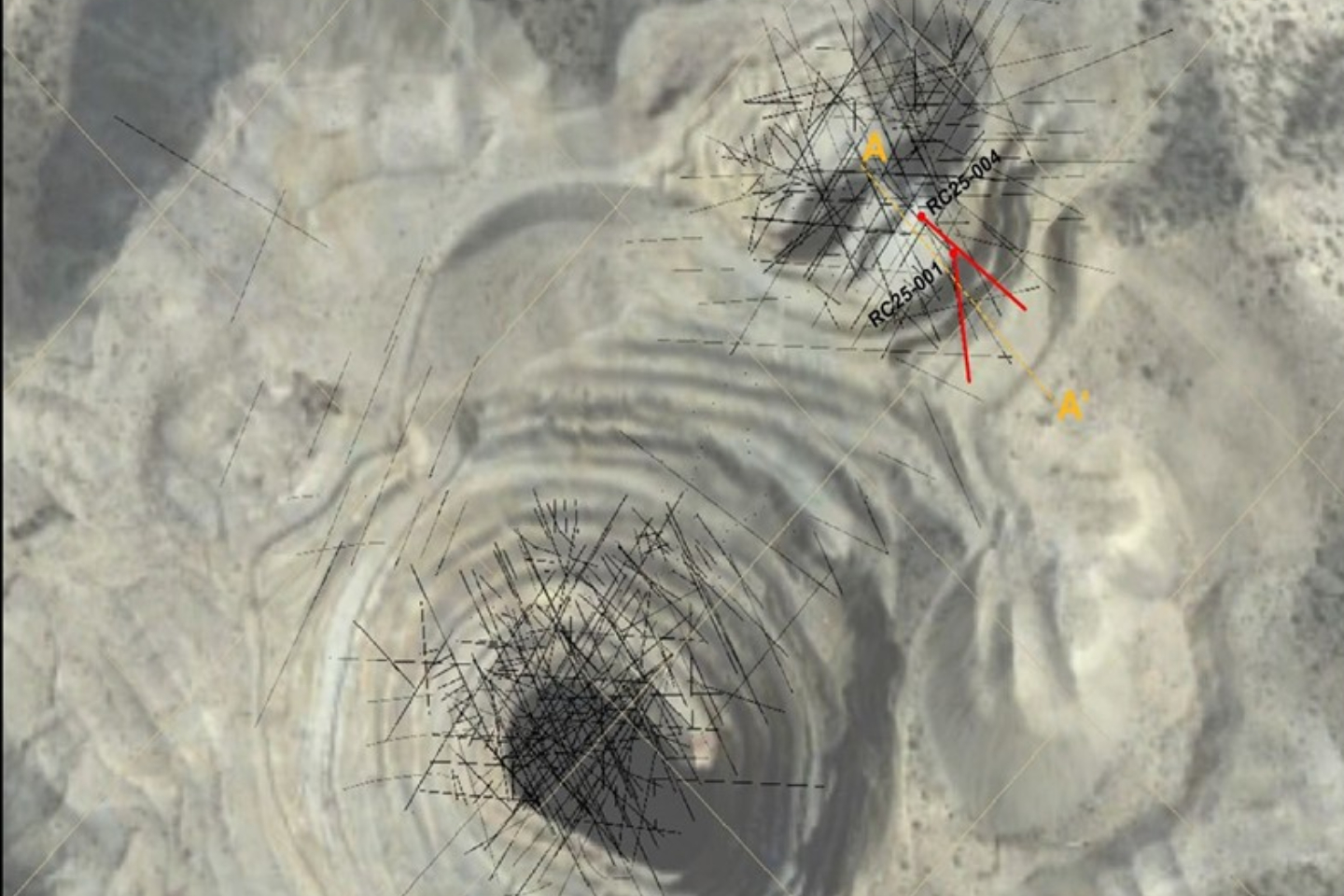

The latest assays stem from two reverse-circulation (RC) holes drilled into Dateline’s North pipe from the base of its pit, which is part of the ongoing program to sharpen the company’s bankable feasibility study (BFS) and bolster the mineral resource base into higher-confidence categories.

The results point to stronger continuity at depth, setting the stage for an upgraded resource estimate early next year.

Drilling took a break over the US Thanksgiving holiday but is slated to crank back up shortly, with more assays in the pipeline.

For a project already carrying 27.1 million tonnes at 1.26 g/t gold for 1.1 million ounces – with over 67 per cent of the resource in the high confidence measured and indicated categories – these hits reinforce the open-at-depth potential and will no doubt add weight to the BFS push at the current $6400 an ounce gold price.

Dateline says the drilling is an interim de-risking step, firming up the resource and mine plan of final economics ahead of future potential production.

The current net present value sits at an impressive US$550 million ($850 million) and an internal rate of return above 60 per cent, based on a conservative US$2900 ($4470) per ounce gold price – numbers that should skyrocket with current spot prices.

Meanwhile, the project's rare earths angle remains in play, with geology echoing the nearby world-class Mountain Pass mine just 10 kilometres south. Drill plans are underway to probe the company’s look-alike carbonatite targets.

Dateline has also recently picked up the strategic Argos strontium project in America, noting that for its scale and historical high-grade output, the prospect screams serious critical minerals upside - ripe for further evaluation.

For now though, the focus is squarely on feeding the gold feasibility study.

With assays still flowing and modelling in progress, Dateline could soon eye a beefier resource tally and improved economics, paving a clearer path for Colosseum to turn into a producing gold mine.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au