The future shape of WA’s energy market has become a little clearer this year, but there are many pieces needed to finish the puzzle.

Goldming giant Newmont is one of the largest energy users in Western Australia, accounting for 5 per cent of all electricity consumed in the South West.

It has also been one of the most active businesses preparing for the energy transition, having struck three deals to lock-in future supplies.

For starters, it has extended a power-purchase agreement with its current supplier, Bluewaters Power, which operates the state’s largest coal power station at Collie.

Newmont has also signed a deal to buy all the electricity and green credits produced at the state’s largest wind farm: Collgar Renewables’ Merredin wind farm.

And it has a memorandum of understanding with Perth company PGS Energy, which plans to build a giant battery and solar farm at Boddington, near Newmont’s goldmine.

The three deals should ensure Newmont has assured power supplies, irrespective of how the energy transition unfolds in WA.

The same cannot necessarily be said for the South West energy market at large, as the state government prepares for the closure of its coal-fired power stations by 2030.

The privately owned Bluewaters power station also faces an uncertain future, especially as state government subsidies for its debt-laden coal supplier, Griffin Coal, expire in 2026.

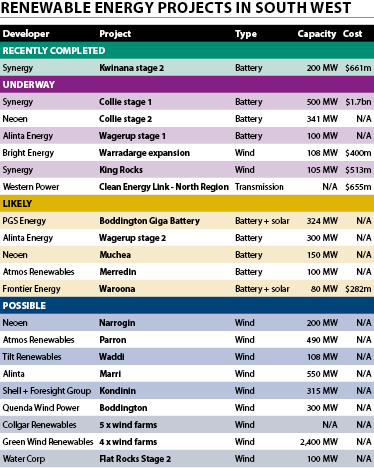

There is a long list of companies aspiring to fill the gap by building grid-scale batteries, also known as battery energy storage systems (BESS), along with new wind farms and solar farms (see table).

Their capacity to enter the market is subject to many variables, not least being the speed at which Western Power expands its transmission network.

Future Smart Strategies managing director Ray Wills told Business News more work was needed to accelerate transmission network upgrades.

“They are not attacking the network issue as fast as they ought,” Professor Wills said.

“A twenty-first century rejuvenation is needed.”

Professor Wills acknowledged one of the issues facing government agencies was that private sector project developers keep on poaching the good staff.

However, he believes more could have been done already.

“It’s not like we didn’t know this was coming,” Professor Wills said.

“A lot of this work could have been done years ago.”

Recently appointed Energy and Decarbonisation Minister Amber-Jade Sanderson said she had met with a wide range of industry stakeholders and peak bodies for feedback on how government could better support the decarbonisation journey.

“I understand that delivering new transmission infrastructure at pace is critical to enable industry’s electrification needs, which will continue to grow rapidly,” she said.

“In addition to our existing commitments to expand the network to the north of Perth, Western Power is undertaking a $324 million program of work to plan for the future of our grid.

“We will have more to say about this over the course of 2025 as we work collaboratively with industry to ensure this plan meets their needs.”

Professor Wills also questions the user-pays approach.

“If we had a mature system, I’d be comfortable with that,” he said.

Ray Wills believes more preparatory work for the energy transition could have been done already. Photo: David Henry

“Right now, it’s an exceptional circumstance. We’re in a phase of state building; it can’t be user pays.”

Ms Sanderson told Business News the government was making the investments needed to enable WA’s renewable energy future, without which projects would struggle to proceed.

“Like keeping Western Power in the hands of the people of WA, ensuring projects contribute sensibly towards the cost of these investments is the right things to do for all Western Australians,” she said.

Green Wind Renewables chief executive Daniel Thompson, whose company aims to build five new wind farms in WA, is broadly supportive of the current approach.

“Western Power is progressing as quickly as possible within the current regulatory and policy constraints, working to evolve connection policies to support the significant increase in new generation required on the SWIS over the next five to seven years,” Mr Thompson said.

Like many in the industry, however, he would prefer a clearer pathway.

“A commitment to a bipartisan plan to build and develop essential infrastructure over a twenty-year horizon, providing clear market signals and timing to industry, would be useful,” Mr Thompson said.

Being built

While the policy debate continues, several recent developments have shed more light on the future shape of the WA market.

These include a first step in upgrading Western Power’s transmission network.

The Clean Energy Link – North Region project, which involves an upgrade to transmission lines between Malaga and Three Springs, is budgeted to cost $655 million.

Local contractor GenusPlus was awarded a $270 million contract early this year to get the project moving.

Two major wind farm projects – the first to start in WA in at least two years – are also under way.

Synergy has started development of its $513 million King Rocks wind farm in the eastern Wheatbelt, while Bright Energy Investments (part-owned by Synergy) is proceeding with an expansion of its Warradarge wind farm north of Perth.

These developments are in addition to multiple BESS projects, which are designed to store energy when wind farms and solar farms have surplus output and release it to the market during peak demand.

Synergy has already spent more than $800 million building two grid-scale batteries at Kwinana and is spending a further $1.65 billion on a larger battery at Collie.

Prime Minister Anthony Albanese joined Premier Roger Cook and Ms Sanderson in Collie this month to mark the completion of installation works at Synergy’s Collie battery.

It was an opportunity for the Labor politicians to talk up their support for renewables while attacking Liberal leader Peter Dutton’s advocacy for nuclear power.

Contractor Southern Cross Electrical Engineering was in charge of installing and connecting 640 batteries and 160 inverters at Synergy’s Collie project.

When completed, the 500-megawatt battery will be able to operate for four hours, producing 2,000MW hours of energy, enough to power 785,000 homes.

Also at Collie, French company Neoen is proceeding with construction of its second grid-scale battery.

The 341MW, four-hour battery is additional to Neoen’s stage-one battery, which has a capacity of 219MW.

Neoen Australia head of development Nathan Ling said that, once complete in the second quarter of this year, the combined battery would have the ability to charge and discharge 20 per cent of the average demand in the SWIS.

For stage one and stage two, Neoen was contracted by the Australian Energy Market Operator (AEMO) through its Non-Co-optimised Essential System Services (NCESS) procurement process for reliability services.

That’s a long-winded way of saying Neoen (and other companies that have won NCESS contracts) will be paid by AEMO for having capacity in place to mitigate potential shortfalls.

The contracts were awarded after AEMO concluded forecast capacity in the energy system presented a significant risk to the system’s security.

Untangling the cost is not simple as it is tied to ‘availability’ payments, ‘activation’ payments and other factors.

A third company building grid-scale batteries is Alinta Energy.

It is in the final stages of constructing a 100MW battery at Wagerup.

Plans for a second, 300MW battery were announced in July last year but the project is not yet under way and no start date is committed.

More batteries

The next tranche of grid-scale batteries in WA is likely to be developed by four companies that have secured federal government backing.

That support comes via the Capacity Investment Scheme (CIS), which essentially underwrites battery storage projects by guaranteeing a minimum level of income.

The first WA tender under the CIS was designed to bring on 500MW of storage projects but attracted substantially more interest.

The four successful projects will have a combined capacity of 654MW, with four hours of storage, meaning they can discharge nearly 2,600MW hours of energy.

Their cost was not disclosed, though the federal government did say the four projects would spend $712 million on local content.

The successful tenders included PGS Energy, also known as Progressive Green Solutions.

With backing from South Korean companies LG Energy Solution and Korea Midland Power Company, it is pursuing development of the 324MW Boddington giga battery and solar farm.

Given this project’s location, Newmont is the logical customer, although the miner says nothing is locked in.

“While Newmont has signed a memorandum of understanding with PGS to enable further discussions about potential future supply options, no decisions have been made,” a spokesperson stated.

Three other companies were successful in the CIS tender.

Neoen plans to build a 150MW battery at Muchea, with construction due to start this year, and Atmos Renewables plans a 100MW battery at Merredin, adjacent to the Merredin solar farm.

ASX-listed Frontier Energy was successful with the first stage of its Waroona renewable energy project, which includes an 80MW battery and solar farm.

The four projects are scheduled to be operational no later than October 2027.

Generation

Amid significant investment in grid-scale batteries, there has been very limited investment in new, commercial-scale wind farms and solar farms in WA.

The next WA tender under the CIS, due this year, may help to change that, as it will target both generation and storage projects.

One pointer as to which projects are at the head of the queue was the federal government’s listing of priority renewable energy projects published earlier this year.

Out of 56 projects nationally, it included three wind farms in the South West Interconnected System, which extends from Geraldton to Albany.

The largest was Atmos Renewables’ 490MW Parron wind farm near Dandaragan, north of Perth.

Tilt Renewables’ 108MW Waddi wind farm is located in the same area.

Both are likely to benefit from Western Power’s north region transmission upgrade.

The third priority project was Neoen’s proposed 200MW Narrogin wind farm.

Neoen’s recent submission to the Environmental Protection Authority said one of the attributes of this project was its location next to Western Power’s existing high-voltage transmission line.

“The ability of this proposal to connect to existing transmission assets with minimal additional infrastructure also means that ongoing maintenance requirements and costs incurred by Western Power are lower than proposals that rely on significant expansion of the network,” Neoen stated in its submission.

Amber-Jade Sanderson in Collie with Anthony Albanese during the federal election campaign.

It noted that alternative areas for large-scale wind farms in the Wheatbelt may require significant upgrades to transmission infrastructure or the establishment of long-distance transmission corridors.

“These additional requirements may delay potential renewable proposals by years and slow the overall transition of the State’s energy network to green energy, particularly within the SWIS,” Neoen said.

Sumitomo subsidiary Quenda Wind Power says its 300MW Marradong wind farm near Boddington has similar attributes.

Other groups pursuing new wind farms include Alinta, Collgar Renewables, investment company Foresight Group, and Green Wind Renewables.

Alinta is aiming to submit environmental approval and development applications for its Marri wind farm near Dandaragan in 2025, with construction slated to start in 2026.

Collgar, which is backed by giant super fund REST, has flagged its intention to build up to five new wind farms in WA, with the first to be operational by 2030. Foresight partnered with oil and gas giant Shell to buy the Kondinin Energy Project in the eastern Wheatbelt in 2022. It comprises a 230MW wind farm, an 80MW solar farm and up to 60MW of battery storage.

Like Neoen, Foresight has talked up the location, saying it was close to Western Power’s 220-kilovolt transmission line, with electricity to flow directly into the existing Kondinin substation

A project update published last month by Foresight said construction was expected to begin this year.

Perth company Green Wind Renewables has ambitious plans to develop five wind farms in the SWIS.

Its four most advanced projects

– the Ambrosia wind farm east of Collie, the Grevillea and Wandoo projects near Moora, and the Banksia project – are being developed in joint venture with Macquarie Group offshoot Aula Energy.

“The first three are slightly further progressed in terms of studies and approvals,” chief executive Daniel Thompson said.

“However, our strategy is to move all four partnership projects forward in parallel.

“By progressing them together, we aim to maximise economies of scale and unlock efficiencies across procurement, grid connection, and financing.”

Green Wind Renewables’ goal is to have all four projects, with a combined capacity of 2.4 gigawatts, operational by 2030.