Micro-investing platform Raiz has capped off 2025 with a blistering performance, delivering record funds under management of more than $1.8B, soaring user growth and a flurry of accolades. With annualised revenue per user on the rise and a new alliance with Drip Invest set to expand its reach, the fintech darling is doubling down on innovation, engagement and expansion as it positions itself for an even bigger 2026.

Micro-investing platform Raiz Invest has wrapped up a stellar fourth quarter 2025, clocking record growth across customer numbers and boosting funds under management (FUM) to more than $1.8 billion, with its Super and Kids portfolios leading the charge.

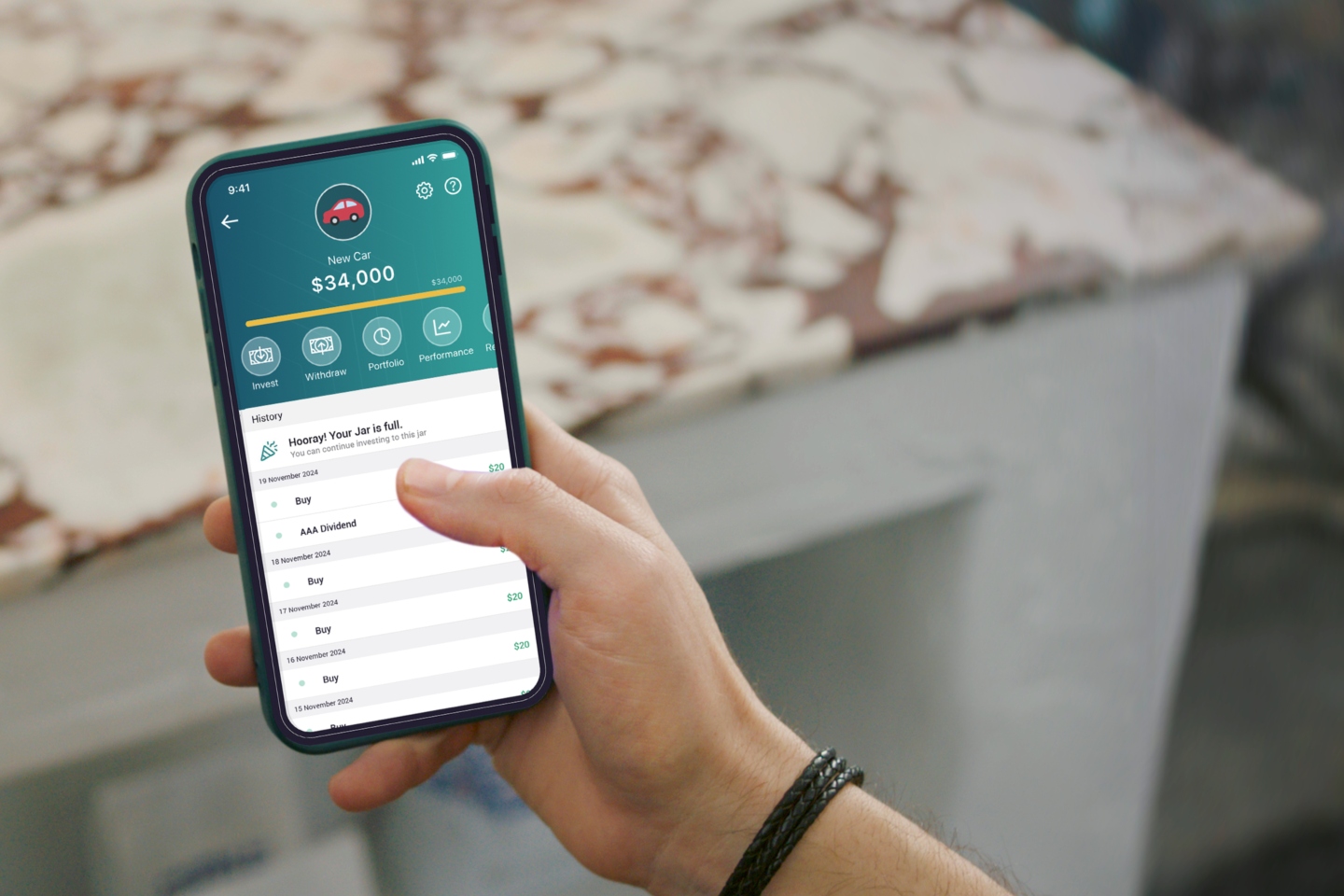

While Raiz runs a classic investment fund behind the scenes, the way it fills the piggy bank is anything but old-school. The company’s simple, app-based platform lets users round up their daily spending - whether for a coffee, or a cab fare - to the nearest $1, $2 or $3. The spare change is automatically whisked into their investment account, one tap at a time.

The company’s active fee-paying customer numbers are now up 7.3 per cent year-on-year to 329,277 users, with an additional 4309 net new users joining the platform in the fourth quarter alone. The momentum continued into July, with customer numbers already surging to 333,233.

Annualised revenue per user also jumped 6.9 per cent to $77.20, driven by a strong uptake of higher-margin products such as its Raiz Plus, Raiz Super and Raiz Rewards platforms.

Funds under management smashed through the $1.8 billion mark to hit $1.82 billion at the end of the quarter, up 30.4 per cent year-on-year and 10.3 per cent for the quarter. The rally was powered by $45.8 million in net inflows and a $125 million boost from market movements.

Management says the business is still gathering pace, with total funds under management hitting $1.88 billion by the close of business yesterday and a suite of new products and features already primed for launch in the first quarter of the new financial year.

While the key metrics continue to shine brightly, Raiz says breakout growth in specific products has caught the market’s eye.

Raiz Super customers soared 20.8 per cent over the past year to 13,965 users, with Super funds under management jumping 34.4 per cent to $387.6 million. Its Kids portfolios also went gangbusters, growing 45 per cent to 54,961 accounts, with funds under management skyrocketing 80.8 per cent to $79.4 million.

The company’s Plus portfolios weren’t far behind, with a 42.2 per cent year-on-year surge in accounts and a 67.4 per cent leap in funds under management to $296.7 million.

Notably, average account balances are also on the up, increasing 21.5 per cent over the year to $5530.

Raiz Invest managing director and chief executive officer Brendan Malone said: “We delivered another convincing quarter of growth and I am particularly pleased to see ongoing incremental increases in ARPU as our highest revenue products maintain strong growth. The business fundamentals remain solid and all core metrics are trending positively.”

As part of its drive to engage younger investors, Raiz recently struck a strategic deal to take on a portfolio sitting under the Drip Invest banner. Drip is an educational investing app aimed at kids and teens and is currently managed by Cache Invest.

Raiz says the partnership - due to go live in the second week of August - gives the company direct access to Drip’s customer base and marketing channels, thereby amplifying its footprint in the youth investor segment.

In efforts to boost its overall marketing arsenal, Raiz is also doubling down on its tech edge by pumping more resources into smarter systems and data capabilities.

By rolling out AI tools to generate hyper-personalised campaigns, the company says it has been able to lift its conversion and retention rates. With an eye on the future, it is also chasing M&A opportunities to supercharge its expansion.

Raiz’s efforts haven’t gone unnoticed. The platform was recently named one of CNBC World’s Top Fintech Companies for 2025 and became a finalist at the Fintech Australia ‘Finnies’ awards for Excellence in Wealth Management. The company also took top spot in the Finder customer satisfaction awards and snagged the WeMoney award for its popular round-up investing feature.

With consistent growth, glowing peer reviews and $13 million in the bank - up 4 per cent from the last quarter - Raiz has set the standard for micro-investing in Australia and appears poised to make 2026 its biggest year yet.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au