Octava Minerals is set to start the drill rods spinning with a 2000m diamond drilling program at its Tasmanian Federation project after uncovering overlimit indium above 500ppm, alongside standout zinc, tin, silver and copper grades from rock chips at the Sweeney’s prospect. The company aims to test unmined sulphide zones in one of Australia’s most promising polymetallic districts.

Octava Minerals is about to fire up the rigs at its Federation base metals project in western Tasmania after uncovering rock chips grading overlimit indium, clocking more than 500 parts per million (ppm), alongside standout grades of copper, zinc, silver, and tin.

The discovery has lit a fuse under the company’s exploration push at the Sweeney’s prospect, where regulatory approval has now been granted for a 2000-metre diamond drilling program. Work on site access and drill preparation is already underway, with the first rigs expected to turn in mid-November. The campaign will target sulphide feeder zones identified in historical drilling that remains open at depth and along strike, with up to 22 holes planned.

Adding more intrigue, Octava is also about to kick off an electromagnetic (EM) geophysical survey across Sweeney’s; the first modern geophysics ever conducted over the area. The survey aims to reveal the true scale and continuity of the mineralisation, which is hosted within resistive country rocks and unmasked by any conductive overburden.

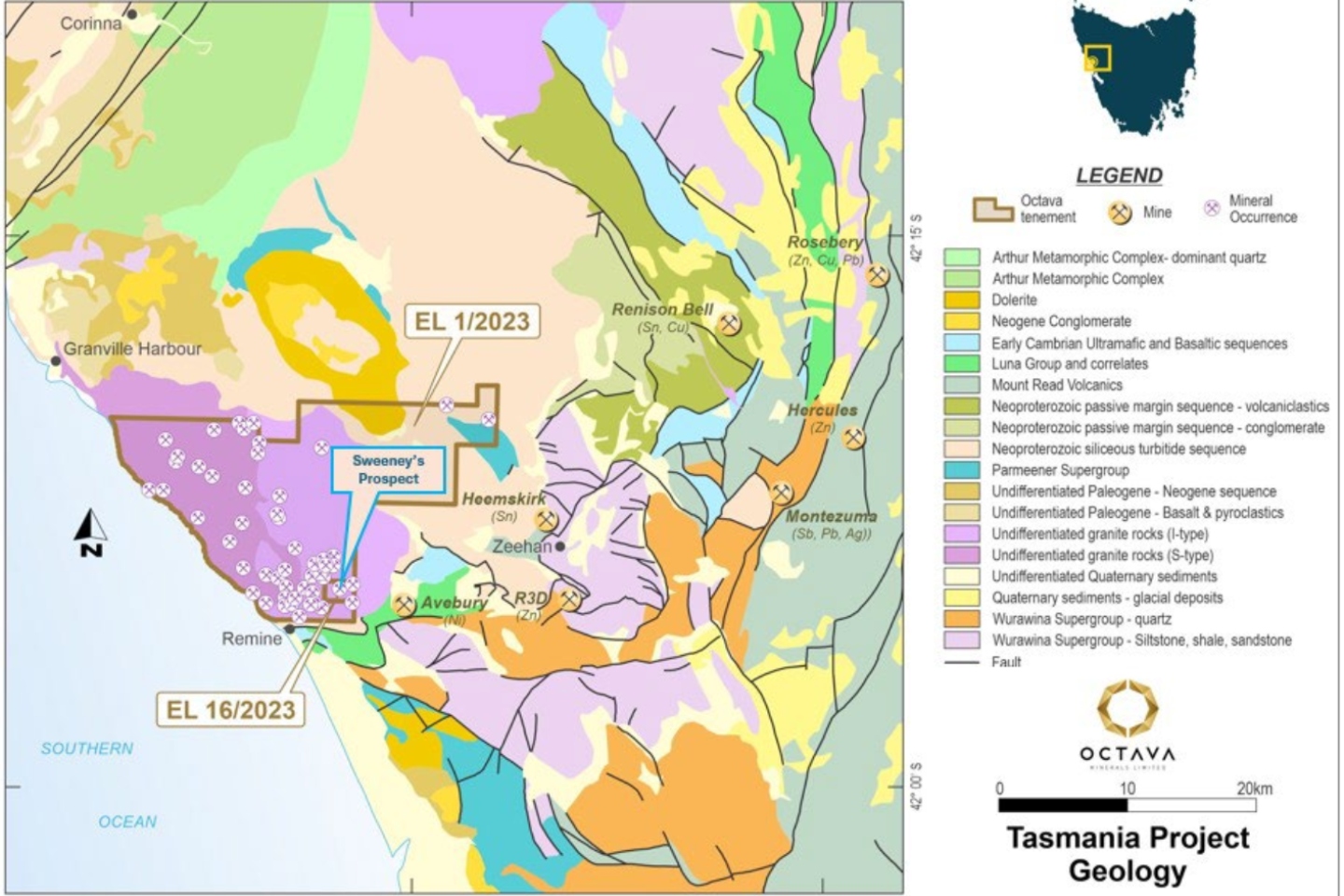

Federation sits just 12 kilometres west of the mining hub of Zeehan, in Tasmania’s mineral-rich northwest - home to the world-class Renison tin mine, Australia’s largest tin producer. Renison has pumped out more than 200,000 tonnes of tin since the 1890s and still boasts a 20-million-tonne resource grading 1.18 per cent tin. Back in the early 1970s, Renison’s geologists focused purely on cassiterite, but 18 drill holes cut into a copper-rich system that’s only now being appreciated.

Intercepts at Renison such as 23 metres at 1.19 per cent copper, 1.7 per cent zinc, 121 grams per tonne (g/t) silver and 1.17 per cent tin from 71 metres underline the polymetallic potential of the district.

Adding further excitement is the presence of indium, a rare and strategic metal used in touchscreens, semiconductors and solar panels, primarily in the form of indium tin oxide. With planetary abundance on par with silver, indium is seldom found in economic concentrations and is typically recovered as a by-product of zinc processing.

Currently, the only known higher-grade indium occurrences in Australia are in North Queensland, meaning Octava’s discovery in Tasmania could be significant. Interestingly, Stellar Resources recently reported similarly high indium grades at its East Renison project, reinforcing the belief that this part of Tasmania may be anomalously enriched in the metal.

Recent rock chip sampling from costeans above Sweeney’s main adit returned a suite of remarkable assays across multiple metals. Four samples exceeded the field-based maximum detection limit for indium (greater than 500ppm) and showed exceptional base metal grades, including: 27.5 per cent zinc, 0.58 per cent copper,1.83 per cent lead, 5.97 per cent tin, 434 g/t silver, and a bonus 0.92 per cent antimony.

Further analysis is now underway to quantify the true indium content in these overlimit samples.

Octava Minerals managing director Bevan Wakelam said the latest approvals and assay results mark a pivotal moment for the company’s Tasmanian campaign. “We are extremely pleased to have received approvals to proceed with the diamond drilling program at Sweeney’s. Preparation work for drilling is already underway and we plan to have the drill rig in place around mid-November. The recent rock chip assay results continue to confirm excellent grades and highlight the potential for significant polymetallic mineralisation, including indium, at the Sweeney’s prospect.”

Geologically, the Federation project sits on the flank of the Heemskirk Granite, a multiphase intrusion that has injected its way through Proterozoic sedimentary rocks, namely quartzites, black shales and carbonate-rich beds which have all been subsequently metamorphosed. The late-stage crystallisation of the granite produced hot saline fluids loaded with metals and regional faults acted as pathways allowing these fluids to precipitate metals into fractures and form the mineralised systems Octava is now probing.

Historic drilling in the area intercepted a steeply dipping, south-southeast plunging mineralised zone from about 70m to 210m depth, dominated by semi-massive to massive pyrite, pyrrhotite, sphalerite along with tin minerals stannite and cassiterite. Despite this, the prospect has remained untouched by modern exploration for more than four decades leaving a compelling opportunity for Octava to unlock its true potential.

Now, with the drill rig about to move in, Octava looks set to start unlocking a polymetallic prize that’s been waiting almost half a century to be rediscovered.

Federation enjoys a strategic location close to existing mining centres, infrastructure and hydro-power stations; a logistical advantage that could fast-track any future development. With the combination of critical metals, robust geology and unexplored depth potential, Sweeney’s is shaping up as a potential cornerstone asset in Octava’s portfolio.

As global demand for critical metals accelerates, especially in the semiconductor and renewable energy sectors, indium and tin are increasingly on investors’ radars. Octava’s early results suggest Sweeney’s could emerge as one of the country’s most exciting polymetallic targets and perhaps one of the few domestic sources of high-grade indium.

If Octava’s upcoming drill campaign delivers anything close to its rock chip results, the company could find itself holding one of Australia’s few high-grade indium discoveries and a front-row seat in the nation’s growing critical minerals story.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au