Aurum Resources has nailed stellar gold hits in infill drilling at its Boundiali project in Cote d’Ivoire, including 1 metre assaying a bonanza 152.35g/t gold, in a 12-hole campaign targeting a pre-feasibility study in the first quarter of 2026. Potential exists for significant resource growth as mineralisation remains open along strike and at depth.

Aurum Resources has delivered a string of impressive gold intercepts from an infill diamond drilling program at the company’s 2.41-million-ounce Boundiali gold project in Côte d'Ivoire, boosting confidence in its BMT3 and BDT2 targets.

The results confirm high-grade, continuous gold mineralisation. Potential exists for significant resource growth as mineralisation remains open along strike and at depth.

At the BMT3 deposit, 42 diamond drill holes for a gnat’s whisker under 7000m of drilling yielded standout results, led by a spectacular 1m assaying 152.35 grams per tonne (g/t) gold from 96m.

Other top hits include 21m at 4.06g/t gold from 128m, including 1.4m going 53.22g/t gold in a second hole, and a third best hole which delivered 5m running 10.80g/t gold from 82m, including 4m assaying 13.45g/t gold.

These results build on previously reported high-grade intercepts from the BM tenement, such as 4.2m going 80.64g/t gold, including 1.43m at 234.35g/t gold, and a remarkable 1.19m at 277.54g/t gold.

The mineralisation is hosted in diorite with disseminated pyrite and quartz veins and exhibits true widths between 60-80 per cent of reported lengths, highlighting robust potential.

At the BDT2 target in the southwest part of the main contiguous tenement group, 11 holes were put in for 2780.1m of drilling, delivering solid results.

The top three intercepts ran 10.5m at 2.39g/t gold from 43.5m, including 1m going 22.81g/t gold, followed by 0.9m running 22.03g/t gold from 126m and 34m assaying 0.46g/t gold from 198m, including 1m at 3.85g/t gold.

Previously reported standout intercepts from BDT2 include 74m grading 1g/t gold, including a best run of 1m assaying 24.73g/t gold in one hole, and a further hole handing over 2m at 22.86g/t gold.

BDT2’s gold, hosted in a sandstone unit with fine pyrite and hematite alteration, showcases true widths of 65 to 80 per cent of downhole lengths, pointing to a substantial mineralised corridor.

Aurum Resources managing director Dr Caigen Wang said: “These spectacular results highlight the immense potential of our Côte d’Ivoire portfolio. The bonanza hit of 1m at 152.35g/t gold from 96m at Boundiali confirms the system at BDT3 hosts high-grade shoots, with this intercept being drilled up-dip from 1.43m at 234.35g/t gold from 107m.”

Wang said, crucially, the latest success is not isolated to the Boundiali gold project. Recent drilling at the company’s Napié project also returned a fantastic result of 17m at 9.38g/t gold from 236m, significantly extending mineralisation at depth.

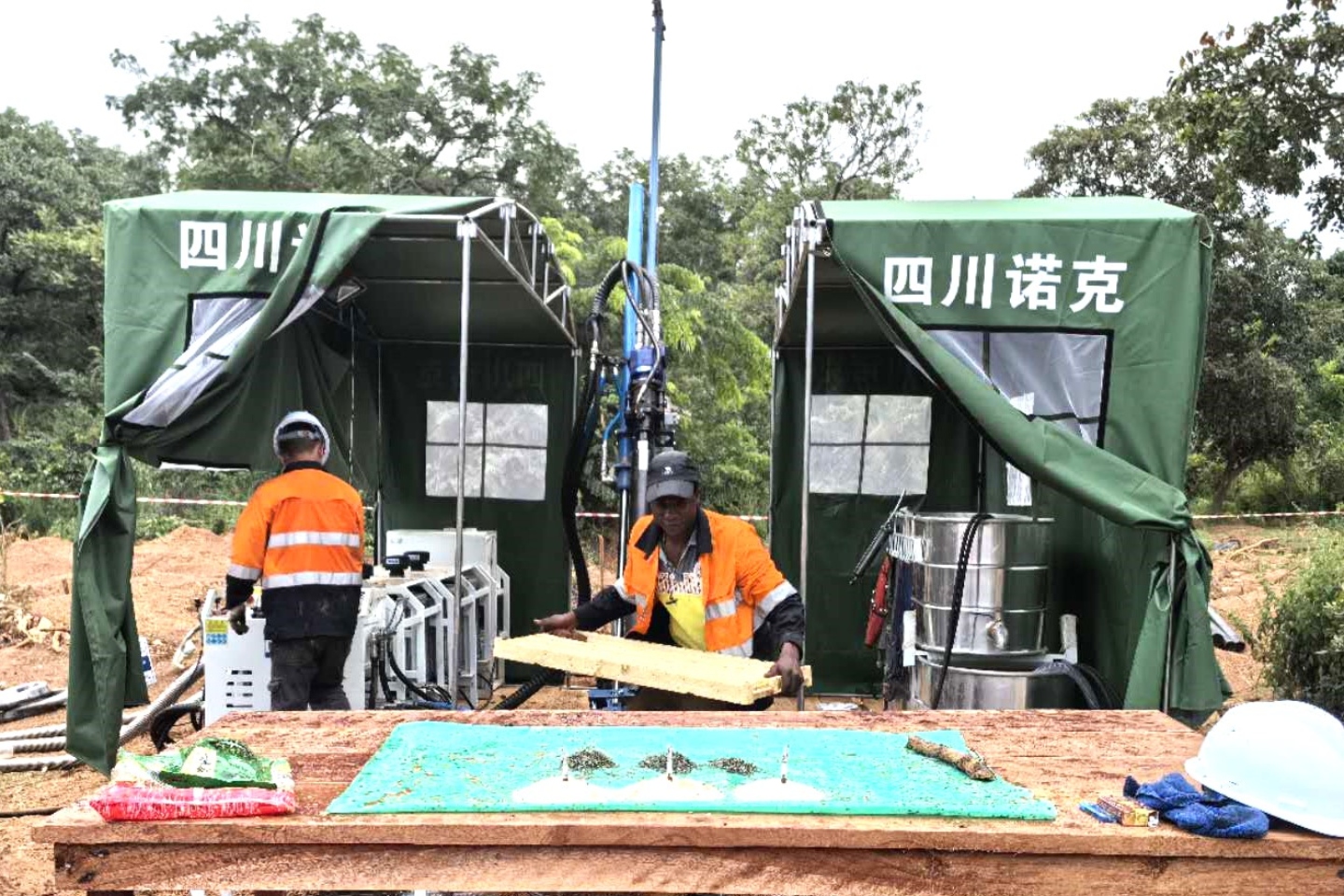

Aurum is aggressively accelerating its exploration with two more rigs, bringing its company-owned fleet to 12. It is targeting increased metreage, from a previously proposed 100,000m of drilling to more than 130,000m in 2025.

The aggressive program aims to expand resources at Boundiali’s BD, BM and BST deposits while also testing new targets to identify further discoveries.

A pre-feasibility study (PFS) for Boundiali is underway, with results slated for the first quarter of 2026. Aurum expects the PFS will be timed alongside two major mineral resource estimate updates for Boundiali and the company’s 0.87-million-ounce Napié gold project, about 100 kilometres southeast of the main Boundiali tenement suite.

With a healthy $40 million cash balance, including shares in African explorer Montage Gold Corporation, Aurum looks well-positioned to sustain its current solid exploration drive and development plans.

Aurum’s latest results from Boundiali have been a cracker outcome for the company, with abundant high-grade hits and open mineralisation pointing to a potentially expanded resource and a bigger future.

With a beefed-up drill fleet and a solid pile of cash, Aurum is charging toward a significant resource expansion around Christmas and a PFS early next year, pointing to a strong possibility of some golden New Year’s cheer to come.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au