Strike Energy says WA’s gas market is set to tighten, despite facing soft pricing conditions over the June quarter.

Strike Energy has warned of a looming supply gap in WA’s gas market, but the ASX-lister’s latest update shows it wrestling with a softer-than-expected pricing environment.

Following a strategic review that brought in new management and ran the ruler over Strike’s portfolio, the gas junior used its latest periodical to talk up development opportunities across its West Erregulla, South Erregulla and Walyering assets in the Perth Basin.

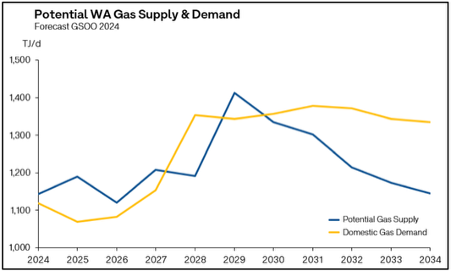

Strike said it was ramping up development as it stared down the barrel of waning energy supply: it claims the long-term outlook for WA’s gas would constrict as coal-fired power assets begin to wind down.

Photo: Strike Energy

“While increased short-term supply is meeting current demand … the longer-term outlook remains tight in 2027-2028 and post 2030,” Strike told investors of the domestic market in Wednesday’s report.

On a national scale, the Australian Energy Market Operator (AEMO), said electricity was performing more reliably in the near-term, but it was still expecting a 50-megawatt energy shortfall come summer.

“The outlook requires ongoing investment in generation, storage and network infrastructure to accommodate retiring thermal capacity and rising peak ramp challenges,” Strike said of AEMO’s findings.

Despite the long-term outlook, Strike admitted that pricing in WA’s spot market had proven softer than expected in recent months, with gas fetching an average of $6.85 a gigajoule over the June quarter — down 13 per cent on the previous three-month period.

Strike’s latest update reveals its sales revenue reached $18.3 million over the June quarter; roughly one per cent lower than the March period.

The company’s average realised gas price was also down circa two per cent, dropping to $7.38 per gigajoule amid lethargic market conditions.

In other news, Strike halved its exploration expenditure during the quarter to $3.3 million, but its development spend more than doubled to $23 million as it ramped up work on an 85-megawatt power station at South Erregulla.

Strike Energy chief executive Peter Stokes said the company’s senior management had been up at the site regularly to keep the project on track.

“We’re very focused on bringing the plant online by October 1 next year,” he told investors during a call on Wednesday.

As focus shifts to development, Strike emphasised the need to keep a healthy bank balance.

Last week, the gas junior flagged an $88 million investment from Carnarvon Energy, which will emerge as the company’s largest shareholder.

Canarvon’s new 19.9 per cent stake, priced at 12 cents per share, will fund development across the South Erregulla, West Erregulla and Walyering projects.

Concurrently, the gas junior is seeking $10 million from investors via a share purchase plan. But it can choose to accept oversubscriptions and raise up to $15 million, at the board’s discretion.

Strike’s cash flow report indicates it maintained $76.2 million in available funding at quarter-end, including $35 million in undrawn credit.

It has a $217 million financing facility with Macquarie ($162 million of which has been drawn down or committed) and a $6 million facility with Rabobank.

Elsewhere in the quarter, Strike withdrew from the L7 and EP437 joint venture blocks in the Perth Basin, citing a lack of prospectivity.

Mr Stokes, who was appointed to lead the gas pundit in June, will oversee Strike’s revised development plan amid the shifting market conditions.

Strike closed out the trading day trading 7.69 per cent lower, with shares worth 12 cents each in a $396 million market cap.