Larvotto Resources is fast closing in on mid-2026 production at its Hillgrove antimony–gold project in NSW, with plant refurbishment on schedule and underground mining back underway. Workforce numbers are ramping up as key permitting milestones fall into place. The company is also advancing rare earth metallurgy in WA and progressing copper growth options near Mt Isa.

Larvotto Resources is fast emerging as a near-term critical minerals producer, with refurbishment works and underground mining activities at its Hillgrove antimony–gold project in NSW on track and, importantly, on budget, ahead of a return to production by mid-year.

Alongside Hillgrove, the company is lining up its next growth moves, eyeing a rare earths opportunity in Western Australia and a promising copper play near Mt Isa in Queensland as potential next chapters in the company’s expansion story.

In NSW, meanwhile, Larvotto has wasted no time shifting its high-grade gold and antimony mine into execution mode, ripping out and dispatching processing plant equipment for refurbishment, while upgrading site services.

Underground mining has also restarted, with contractor PYBAR now fully mobilised. Rehabilitation of more than 2,500 square metres of underground drives is now complete and waste haulage is underway ahead of ore development blasting expected in early February.

Workforce numbers are ramping up in parallel, with Larvotto forecasting an increase in full-time staff from 53 to 162 by the end of June, positioning the operation for commissioning and first production. Regulatory momentum is also building, with the public exhibition period for a key mine life extension now underway.

Hillgrove places Larvotto in the box seat to become Australia’s next antimony producer at a time when the metal has been prioritised under the Federal Government’s $1.2 billion Critical Minerals Strategy. Strong gold and tungsten prices add further leverage as the project edges closer to cash flow.

Larvotto Resources managing director Ron Heeks said: “With Hillgrove on the verge of production at a time of unprecedented global demand for critical minerals, we are working on being the next Australian producer of antimony. The recent prioritisation of antimony under the Australian Government’s $1.2 billion Critical Mineral Strategy highlights the importance of antimony and supports Larvotto’s emergence as a leading new critical minerals producer.”

Larvotto says community engagement remains a top priority, with regular drop-in sessions at its Hillgrove Hub and strong partnerships forged with local schools and Traditional Owners. The approach has paid off, earning the company finalist honours in the 2025 AMEC Community Contribution Award.

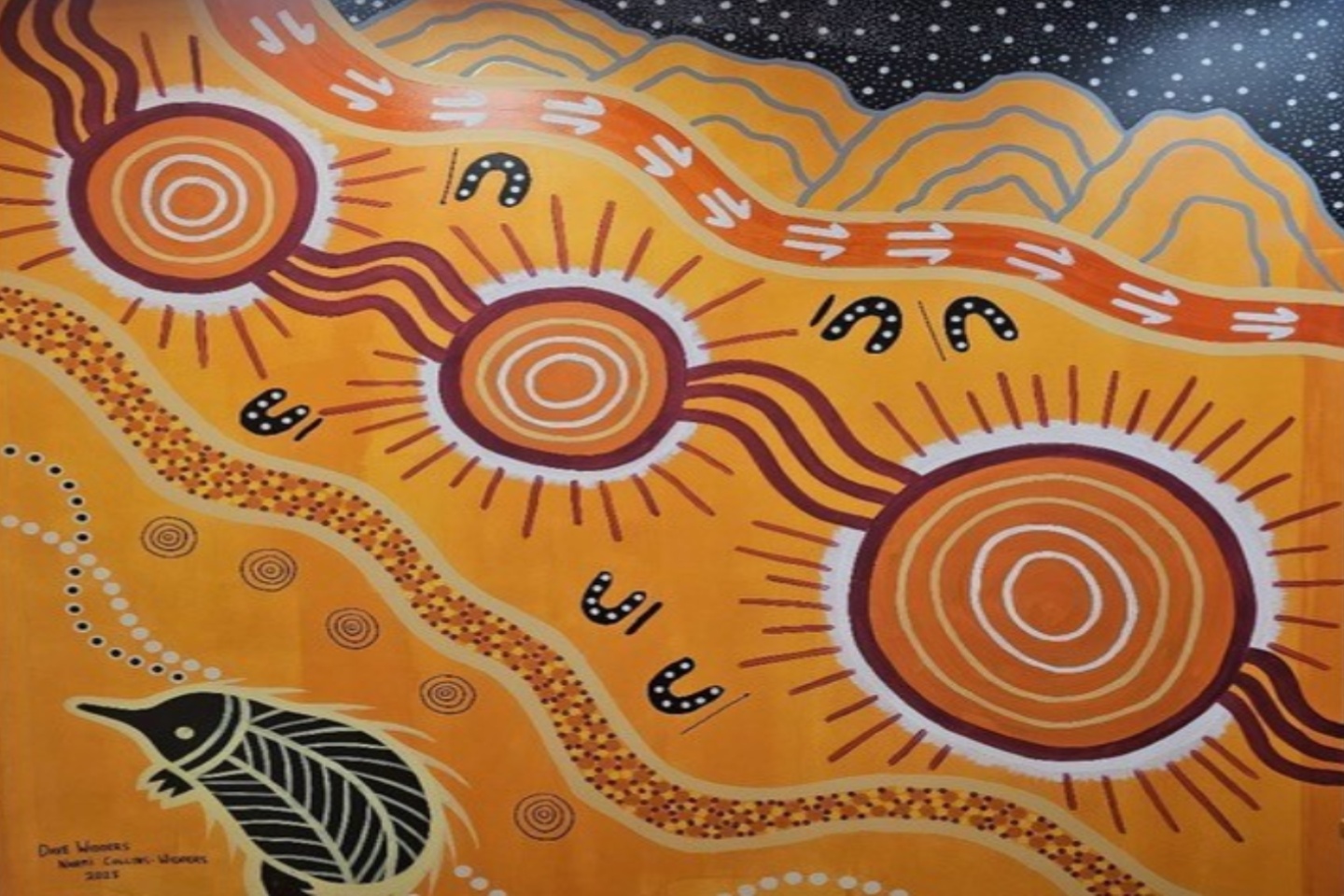

From hands-on agricultural education and controlled grazing to manage fire risk, through to celebrating culture with a striking Anaiwan mural, management says it is keen to embed long-term social, environmental and cultural value alongside mine development.

In a big tick for farmers and bushfire management, Larvotto has kicked off a grazing and community farm initiative at Echidna Gully Village, introducing cattle onto pastoral land to support agricultural education partnerships with local schools. The program aims to promote the practical benefits of controlled grazing by helping manage vegetation, thereby reducing fire risk around the site.

Beyond Hillgrove, Larvotto says it’s steadily building the company’s next growth engines. At its Eyre project in Western Australia, aircore drilling has wrapped up to feed rare earths metallurgical test work. Laboratory studies are now underway to probe mineralogy, recoveries and processing pathways across a suite of promising targets.

In Queensland, meanwhile, the company has continued to make progress on its due diligence at the historic Blockade copper mine near Mt Isa, where more than 4,100 metres of reverse circulation (RC) drilling has been completed across five nearby prospects.

Visual results so far from Blockade have hinted at multiple copper-mineralised zones, with assays pending and results set to guide potential resource modelling and a decision on acquisition. The Mt Isa assets could underpin a potential hub-and-spoke copper development strategy close to existing processing infrastructure.

With refurbishment works accelerating, underground mining back in motion and multiple exploration and acquisition catalysts on the horizon, Larvotto is shaping up as a tightly focused near-term antimony and gold producer with meaningful upside across copper and rare earths.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au