Australia’s inflation eased to 2.1 per cent in the June quarter, bolstering expectations the Reserve Bank will cut interest rates at its August meeting.

Inflation has fallen to its lowest annual rate in close to four years, strengthening the case for the Reserve Bank of Australia to cut interest rates when it meets in August.

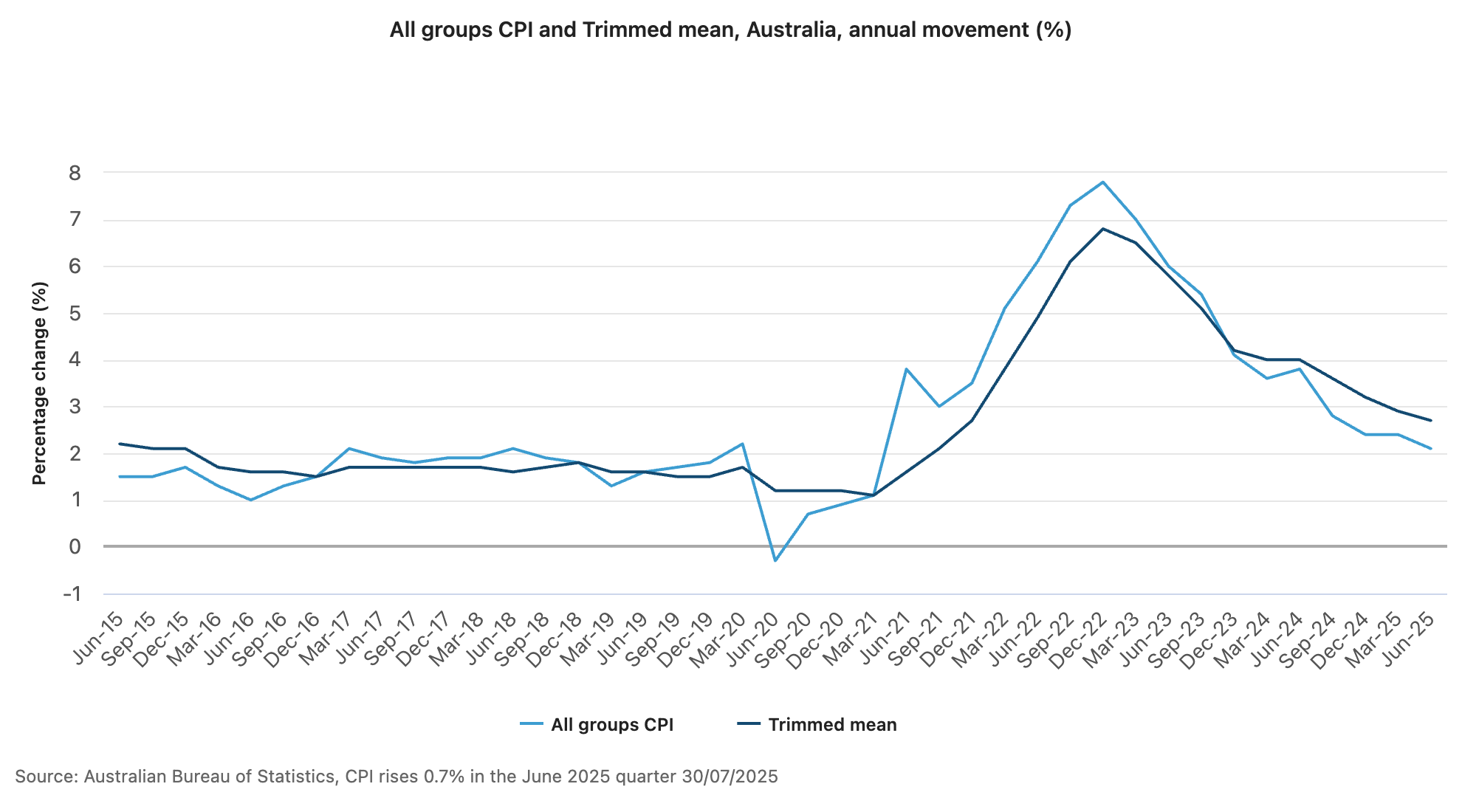

Figures released by the Australian Bureau of Statistics today show the Consumer Price Index (CPI) rose 0.7 per cent in the June 2025 quarter and 2.1 per cent over the year, down from 2.4 per cent in the March quarter.

It is the smallest annual rise in prices since the March 2021 quarter.

Treasurer Jim Chalmers said the latest figures represented "remarkable, outstanding progress" in the fight against inflation.

"What we have seen today is quarterly inflation, monthly information, headline and trend mean, goods and services inflation all come down.

"This is the lowest inflation in almost four years."

The RBA’s preferred measure of underlying inflation, the trimmed mean, also declined — from 2.9 per cent to 2.7 per cent — broadly in line with the bank’s expectations and further evidence that inflationary pressures are moderating.

Westpac chief economist Luci Ellis said the June figures confirmed inflation was under control and signalled likely interest rate cuts in August, with further easing on the horizon.

“Further cuts in November, February 2026 and May 2026 also look increasingly likely,” Ms Ellis said.

Prices for housing, food and non-alcoholic beverages and health were the biggest contributors to the 0.7 per cent CPI rise in the June quarter.

Housing costs were up 1.2 per cent, driven by an 8.1 per cent jump in electricity prices, as earlier government rebates were used up.

Food and non-alcoholic beverages also rose 1.0 per cent, with a 4.3 per cent rise in fruit and vegetable prices brought on by seasonal supply issues, according to the ABS.

Health costs also climbed 1.5 per cent, largely due to the annual increase in private health insurance premiums.

Meanwhile, transport prices fell 0.7 per cent in the quarter, with a 3.4 per cent drop in automotive fuel prices reflecting lower global oil prices.

Fuel prices have now declined in three of the past four quarters and are 10 per cent lower than a year ago.

On an annual basis, food prices remained elevated (up 3.0 per cent) with fruit and vegetables up 4.6 per cent.

Eggs rose 19.1 per cent due to bird flu-related supply issues, while coffee, tea and cocoa were up 9.4 per cent due to global production shortfalls.

Overall, goods inflation slowed to 1.1 per cent, while services inflation eased to 3.3 per cent — its lowest level in three years — reflecting easing cost pressures for rents and insurance.

The ABS also released monthly inflation data, showing CPI rose 1.9 per cent over the year to June, down from 2.1 per cent in May.

The inflation data comes after the national unemployment rate rose from 4.1 per cent to 4.3 per cent in June, its highest level in three years.

RBA governor Michele Bullock said the board was watching labour market trends closely.

Ms Ellis said today’s CPI figures gave the central bank room to move.

“Today’s data removes any awkwardness posed by inflation remaining too high for the RBA’s comfort, at the same time that the labour market might be starting to ease again,” she said.